What Are Exchange Rebate Schemes? A Complete Guide with Images & Examples

Understanding Exchange Rebate Schemes: A Visual Guide for Crypto Traders

In the competitive world of cryptocurrency trading, every fraction of a percent in fees matters. This is where exchange rebate schemes come into play, acting as powerful incentives to attract and retain users. At its core, an exchange rebate scheme is a program where a trading platform returns a portion of the fees you pay—or rewards you for bringing in new users—back to you. Think of it as getting cashback on your trading activity. For both novice and experienced traders, these schemes can significantly reduce costs and enhance overall profitability, turning frequent trading from a costly endeavor into a more sustainable one.

How Do Crypto Exchange Rebate Programs Work? (With Simple Illustrations)

To visualize how these programs function, imagine a typical trade. You place an order, and the exchange charges a small fee, often 0.1% to 0.2%. Under a standard rebate scheme, a percentage of that fee—say 20% to 40%—is credited back to your account. This can happen instantly or at the end of a set period. Another common model is the tiered volume-based rebate. Here, the more you trade, the higher your rebate percentage climbs. A conceptual image would show a ladder, with trading volume on one side and the increasing rebate rate on the other, encouraging higher activity. The third major type is the affiliate or referral rebate, where you earn a commission from the trading fees generated by users you refer to the platform.

Key Types of Rebate Schemes Explained with Examples

Let's break down the main categories you'll encounter. Maker/Taker Fee Rebates: Many exchanges differentiate between "maker" orders (adding liquidity to the order book) and "taker" orders (removing liquidity). They often offer higher rebates for maker orders to incentivize providing liquidity. A diagram here would contrast the two order types and their respective rebate rates. VIP Tier Programs: Exchanges like Binance, OKX, and Bybit run sophisticated VIP programs. Your 30-day trading volume determines your tier. An infographic of a VIP tier table clearly shows how trading volume correlates with lower fees and higher rebates. Referral & Affiliate Bonuses: This is a hugely popular scheme. You share a unique referral link; your friend signs up and trades. You then earn a percentage of their trading fees for a set duration. Flowcharts are perfect for illustrating this process from link sharing to commission earning.

Why Are Rebate Schemes So Crucial in Cryptocurrency Trading?

The impact of rebates extends beyond simple cashback. For active traders and institutional players, fee structures are a primary consideration. A robust rebate scheme can turn a platform with mediocre fees into the most cost-effective choice. It directly boosts net returns, especially for high-frequency trading strategies where fees can quickly erode profits. For the exchanges themselves, these schemes are vital customer acquisition and retention tools. They foster community growth through referral programs and build loyalty by rewarding the most active users. In a market with thin margins, the ability to recoup even 20% of your fees can be the difference between a profitable and a losing month.

Identifying the Best Rebate Programs: What to Look For

Not all rebate schemes are created equal. When evaluating, savvy traders look beyond the headline rate. First, check the rebate calculation basis—is it on net fees after any other discounts? Second, examine the payment frequency and method: are rebates paid daily in USDT, or monthly in the platform's native token? Third, scrutinize the terms and conditions. Are there hidden caps, or do rebates only apply to certain trading pairs? A useful checklist image can help traders audit a program. Furthermore, independent "rebate affiliate" websites exist that offer an additional layer of rebates on top of the exchange's own program, effectively sharing their commission with you. Always ensure these third-party services are reputable.

Potential Risks and Considerations for Traders

While attractive, rebate schemes require a cautious approach. The primary risk is overtrading. The desire to reach a higher VIP tier or generate more rebates can tempt traders to execute unnecessary trades, potentially leading to losses that far outweigh the rebate benefits. Always trade based on strategy, not incentives. Secondly, be aware of platform risk. Some smaller exchanges may offer sensational rebates to attract users but lack the security or liquidity of established players. Never compromise on fundamental exchange safety for a slightly better rebate. Finally, understand the tax implications in your jurisdiction; rebates are often considered taxable income.

Maximizing Your Returns: A Strategic Approach to Rebates

To truly benefit, integrate rebates into your overall trading strategy. Start by consolidating volume on one or two exchanges to climb VIP tiers faster. Use comparison tables to choose the platform with the best effective fee rate after rebates for your typical trade size and frequency. If you are part of a trading community, leverage referral programs strategically. Consider using trusted external rebate portals for an extra boost. Most importantly, keep a simple spreadsheet to track your rebate earnings against your trading fees and profits. This data will reveal the true net cost of your trading and help you make informed decisions about which platforms and schemes deliver the most value for your specific style.

The Future of Incentives in Crypto Exchanges

The landscape of exchange rebates is evolving. We are seeing a trend towards more personalized and dynamic programs, powered by data analytics, that offer tailored incentives. The integration of Decentralized Finance (DeFi) principles is also emerging, with some platforms exploring tokenized rebates or governance rights tied to rebate earnings. Furthermore, as regulatory frameworks mature, the transparency and structure of these schemes will likely become more standardized. For the trader, this means rebates will remain a permanent and sophisticated feature of the crypto trading ecosystem, continually offering opportunities to optimize cost-efficiency and maximize gains in the digital asset markets.

“What Are Exchange Rebate Schemes? A Complete Guide with Images & Examples” 的相关文章

金沙入链:BSGM_携手_Streamex,打造受监管的实物资产代币化新纪元

金沙入链:BSGM 携手 Streamex,打造受监管的实物资产代币化新纪元标签: RWA 代币化 FINRA SEC 经纪自营商 金融合规 纳斯达克 黄金代币目录· 传统与未来的融合:BSGM 的战略新篇章· 牌照的金色钥匙:开启受监管的 RWA 蓝海· 先发制人的野...

洞察先机;加密货币现货交易者如何利用期货市场数据

洞察先机:加密货币现货交易者如何利用期货市场数据加密货币 期货市场 现货交易 市场分析 价格预测 交易策略 风险管理目录· 拨开迷雾:期货合约的本质与魅力· 未来的线索:期货市场如何指引现货方向?· 基差的秘密:市场情绪的晴雨表· 波动性的低语:预判市场风暴的...

超越“数字黄金”;以太坊的无限可能与蜕变之路

超越“数字黄金”:以太坊的无限可能与蜕变之路以太坊 区块链 ETH 智能合约 DeFi NFT Web3 权益证明目录· 以太坊:不仅仅是数字货币,更是全球计算机· 以太坊、以太币与 ETH:概念辨析· 智能合约的魔力:自动化信任的基石· 以太坊的“进化论”:...

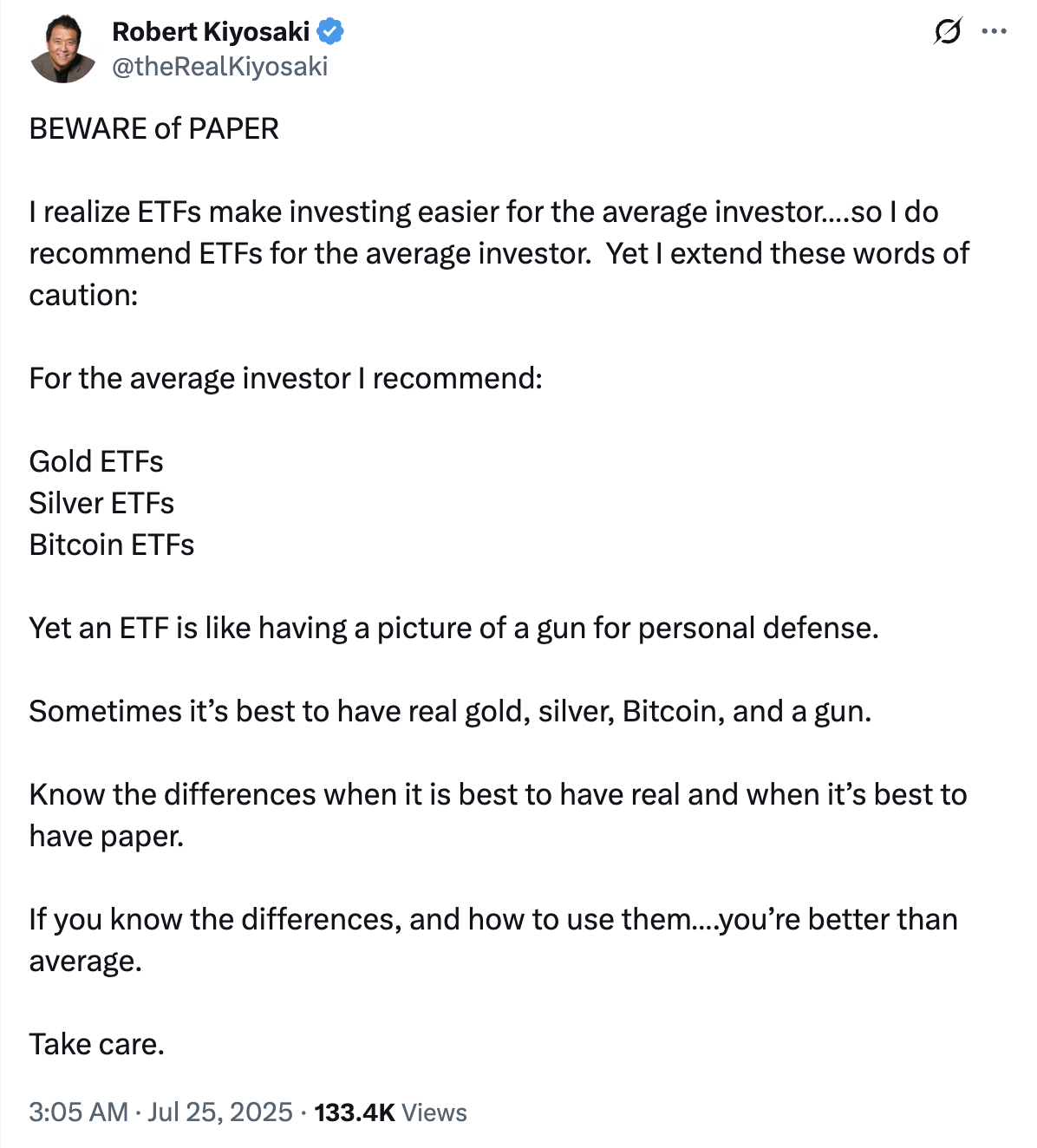

数字黄金的“纸”与“实”;清崎警告ETF风险,专家力证其安全性

数字黄金的“纸”与“实”:清崎警告ETF风险,专家力证其安全性标签: 罗伯特·清崎 比特币ETF 黄金 白银 实物资产 纸质资产 银行挤兑目录:· 序章:富爸爸的“枪支比喻”· 清崎的担忧:警惕“纸上财富”的幻象· 银行挤兑:一个古老的金融梦魇· ETF的防线...

欧易官方网站入口 OKX欧易注册登陆入口以及App下载中心

在全球数字货币交易平台中,欧易(OKX) 凭借强大的技术实力、完善的产品矩阵与严格的安全保障,早已成为广大用户信赖的加密资产交易平台。无论你是新手入门还是专业投资者,选择欧易官方网站入口,即可轻松开启一站式数字资产服务体验。本篇文章将详细介绍: 欧易OKX官网网页版登陆与注册入口...

数字黄金与实体黄金的马拉松;比特币的短期失色与长期霸主地位

数字黄金与实体黄金的马拉松:比特币的短期失色与长期霸主地位标签: 比特币 黄金 资产表现 投资回报 长期趋势目录:· 序章:一场不寻常的年度竞赛· 2025年的意外领跑者:黄金的逆袭· 大局为重:比特币的“天文数字”级回报· 年度化收益:无与伦比的霸主地位·&...